Streamline GST Compliance with GSTR-2B Reconciliation in Dynamics 365 Business Central

Introduction:

In today's dynamic business world, staying compliant with tax regulations is of paramount importance. For businesses operating in India, complying with Goods and Services Tax (GST) requirements is a critical aspect of their financial operations.

With the introduction of GSTR-2B reconciliation, businesses now have a powerful tool at their disposal to simplify and streamline the GST return filing process. In this blog, we'll explore a functionality developed for Dynamics 365 Business Central that enables seamless GSTR-2B reconciliation, making GST compliance a easy for businesses in India.

The Significance of GSTR-2B Reconciliation:

Before delving into the technical details, let's understand the significance of GSTR-2B reconciliation. GSTR-2B is a crucial GST return form generated by the GSTN portal, providing businesses with a consolidated view of their inward supplies. It's essentially a purchase-related summary of the GSTR-1 and GSTR-5 filed by the suppliers.

However, businesses often struggle with matching these purchase details with their own records, leading to discrepancies and potential compliance issues. This is where the GSTR-2B reconciliation functionality for Dynamics 365 Business Central comes into play, offering a comprehensive solution to ensure GST returns are filed accurately and on time.

Key Benefits of GSTR-2B Reconciliation in Dynamics 365 Business Central:

Efficiency: Manual reconciliation can be time-consuming and error-prone. This functionality automates the process, saving valuable time and reducing the risk of errors.

Accuracy: By automatically matching purchase data with GSTR-2B, businesses can significantly reduce the chances of discrepancies in their GST returns.

Compliance: Ensures that your GST returns are filed in compliance with the latest regulations.

Real-time Updates: Provides real-time updates on the reconciliation status, enabling businesses to take corrective actions promptly.

Enhanced Visibility: Gain better visibility into your financial operations and ensure that all your input tax credits are claimed accurately.

Data Import: Allows businesses to import GSTR-2B data from the files downloaded from the GSTN portal, eliminating the need for manual data entry.

Automated Matching: Utilizes intelligent algorithms to match purchase data with GSTR-2B data, flagging any discrepancies for review.

What is covered in this functionality ?

- Auto Matching of the records matching GST Registration no., Supplier's GST No., Document No., GST Base amount and GST Amount including cess, Bill of entry no. etc.

- Force Matching of the records in case a Manual Matching is required.

- Un-matching wrongly matched record.

- Posting the reconciliation to update the reconciliation on various document and Tax ledger entries in Business Central.

- Undo Posting in case of wrong posting.

- Different Return filing and Reconciliation period data in case credit related to past month but reconciliation is posted in the current period.

- Matching of Credit availability with GSTR-2B and Books data. This makes sure that if GSTR-2B disallows the credit then the same is not availed in books.

- Different locations and different GST registration no. reconciliation. Reconciliation of Taxable Stock Transfer.

- Reconciliation of credit distributed by Input Service Distributor.

Still unsure how it will work or look? Well ! Let's have a quick walkthrough of the functionality.

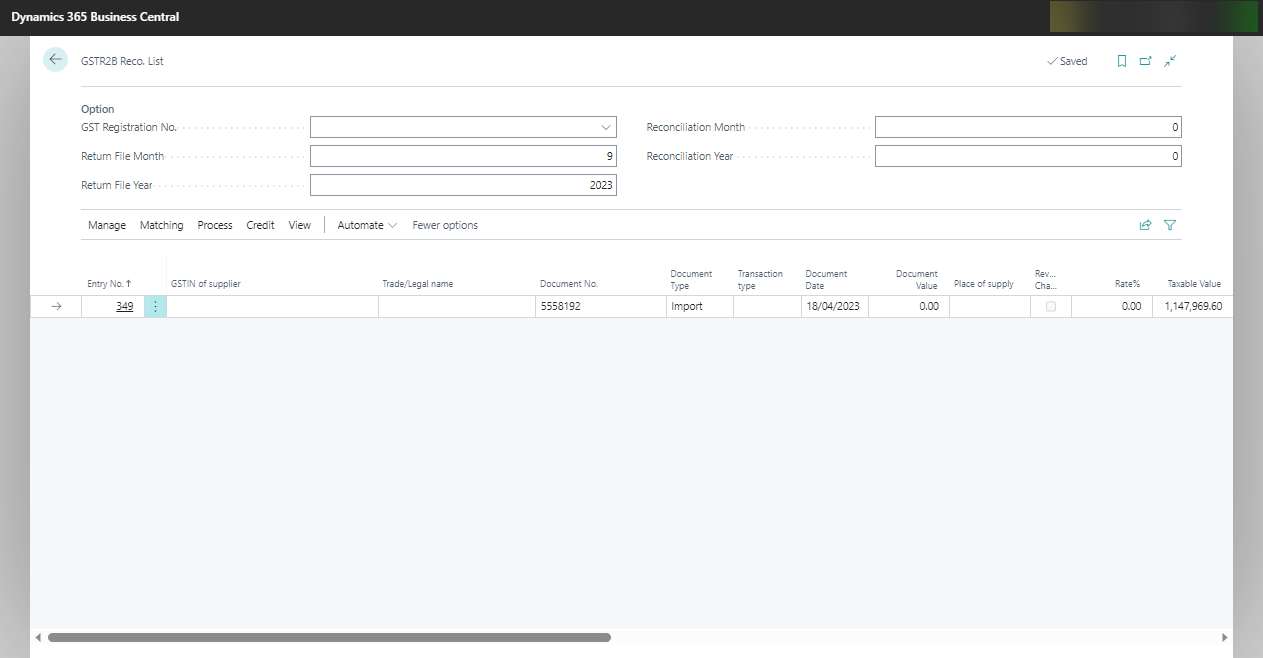

- When you open the GRTR-2B Reco. List, you will land on below page.

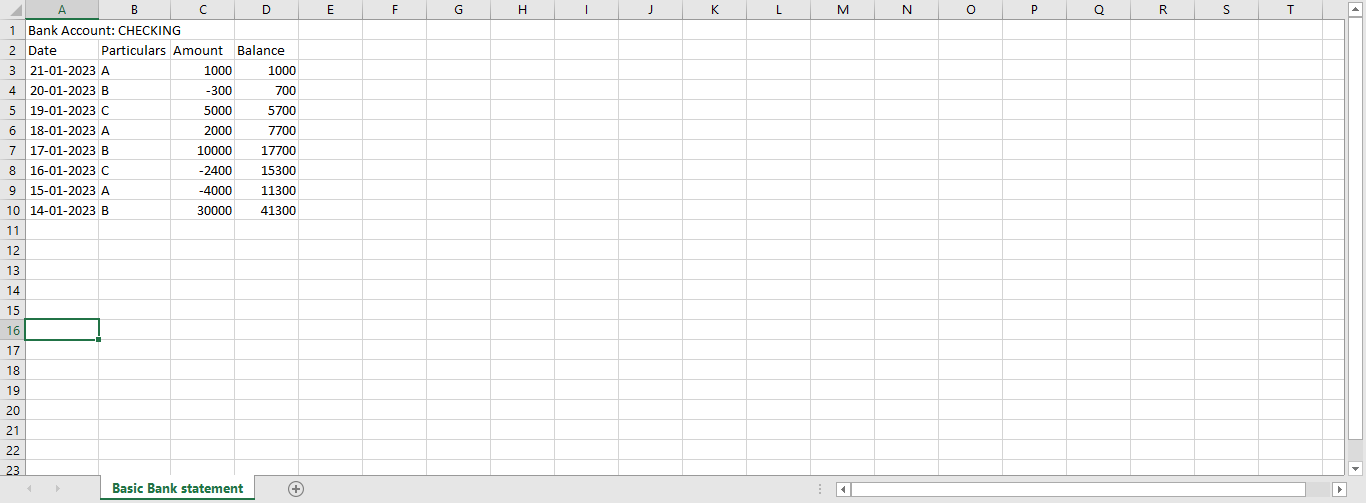

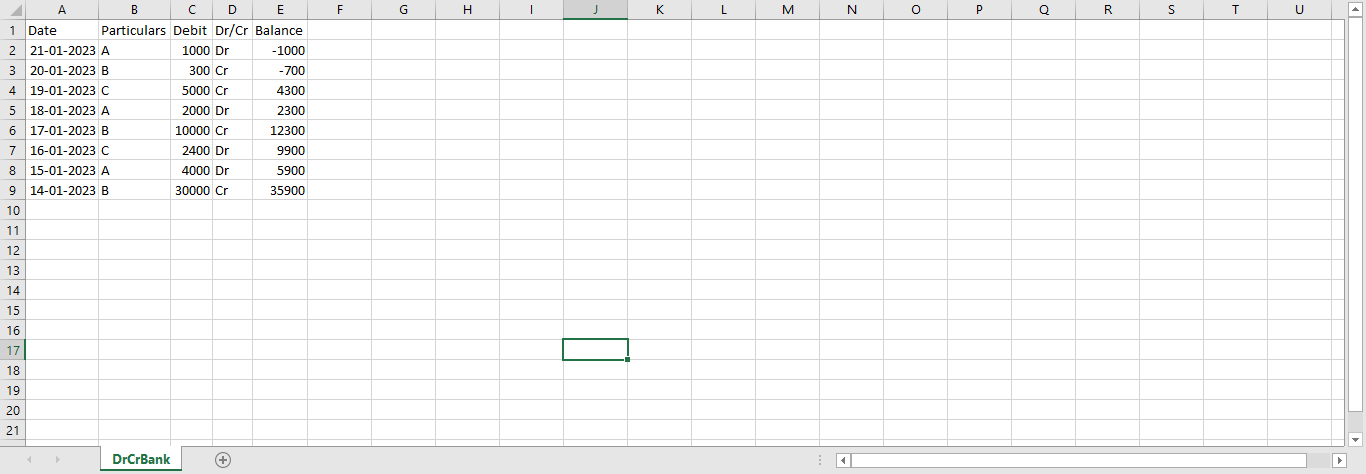

- Download GSTR-2B File in Excel format from GSTN portal. You can import the file directly into Business central.

- System will import all the records of Invoice, Credit Note, Debit note, Imports and Input service Distributor documents. If you have multiple GST registrations then you can import multiple Excel file and system will show you all the record. Do not worry about importing a file twice or for duplicate record as system will give message and will not import duplicate records.

- Not only that but you can easily filter the record imported with the options given on header by GST Registration No., Month and Year of return.

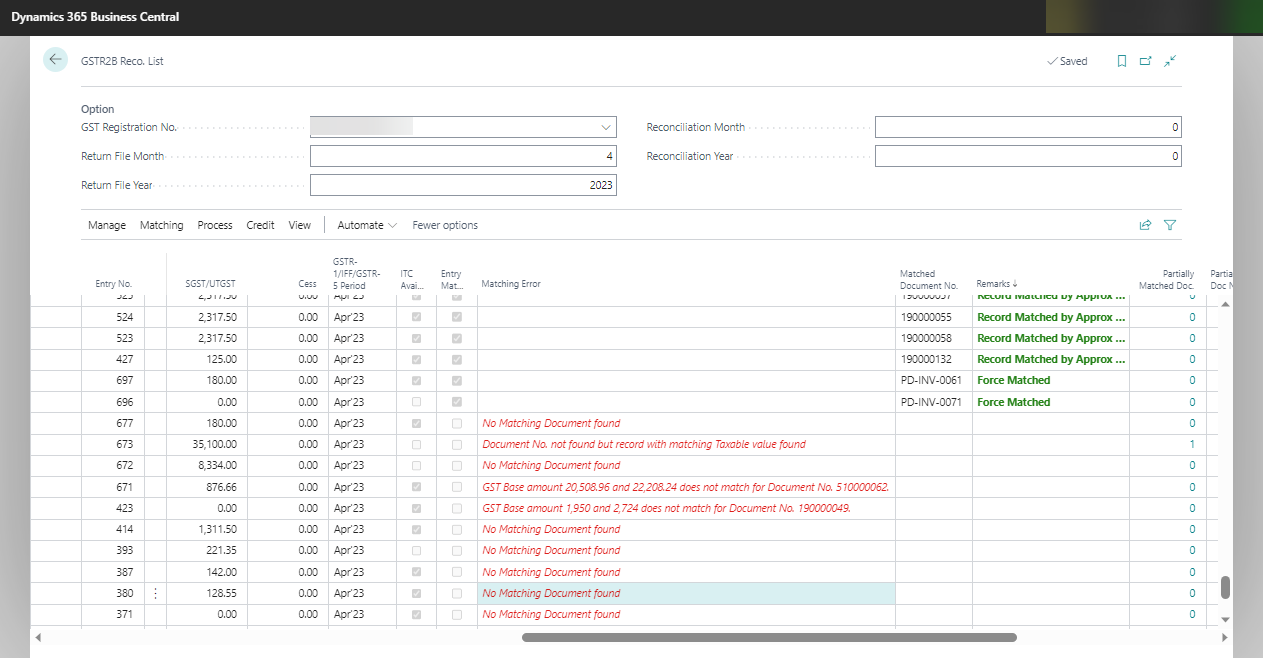

- Now go ahead and click on Match Entry option. This will automatically match all the imported records with the data in books. System will check GST Registration no., Supplier's GST No., Document No., GST Base amount and GST Amount including cess, Bill of entry no. etc. and match the record with books. If any discrepancies are found then the same will be shown in the Matching error column with proper description.

- While doing the matching even if your Document no is different because the accountant has added year or month or extra symbols like '/,\,,,_,-,.' then system will ignore these character and match the document.

- Let's say still the document no. is not matched, well system will give you the list of record for which document no. is not matching but GST Base amount and GST Amount is matching for you to choose and reconcile easily.

- System will also warn you if there is some records for which GSTR-2B does not allow to take credit but in books you have taken the credit of the same.

- Apart from this system gives option to Force match any record which system could not auto match, or Un-match any record if wrong matching is done and to Auto Match single partially matched record i.e. if there are multiple records which has only 1 partially matched record then mostly those are the correct matching record and with single click you can match all those records.

- Once all the entries are matched you need to provide Month and Year in which you are posting the reconciliation, this is because the credit you are matching can be for any of the past months. Then click on Post. This will post the reconciliation for all the matched record in their Detailed GST Ledger entry, Invoices, Credit Memo, Detail Distribution Ledger entries(In case of ISD).

- Once posted you can check the posted records with View Posted Entries option. View Document option can be used to directly open the document that is matched with 2B Record from the same page.

Comments

Post a Comment