Auto generate GST rates in Business Central (Indian Localization)

Hello Readers, Greetings to you.

This is my first blog on Business Central. I have been working on Business Central for approx. 2 years and so far, I have done 3 end to end implementation projects in India. By qualification I am a Chartered Accountant and specializes in Finance, Fixed Assets, SCM, Marketing, Warehouse and Setup & configuration modules of Business Central.

From the very first day of my learning of Business Central ERP, I had keen interest in knowing its database infrastructure and AL programming. Thanks to this interest, I learned about objects in Business Central and later on I started learning AL programming from basics. I am not from IT background, but I learned few things about AL from various sources. After learning it was time to test my skills and hence, I decided to do some coding and what is the better way than to create an extension which is easy to develop but useful to most of the Business Central users.

In these three implementations during my tenure, I found that users are having trouble creating GST rates in Business Central. Though Microsoft has removed the HSN/SAC code from mandatory field it is still tough for those clients who has locations in multiple States or are dealing with entities in multiple States in India and outside India. Hence, I have developed a solution and I have showcased the same in this blog.

GST Rates Functionality:

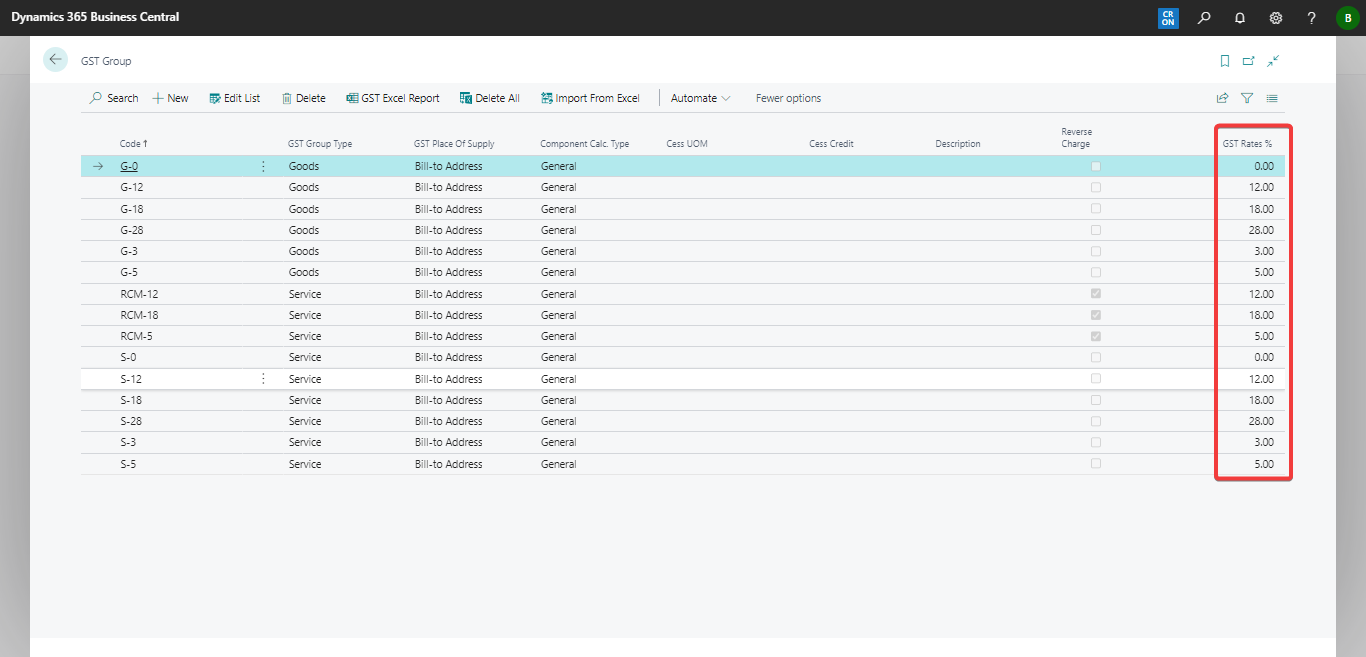

1. To use this functionality, you need to define your GST rates against each GST Group Code. So, I usually suggest the clients to create GST Group Codes, GST rate wise only as it is much easier for both implementation team and users, such that if for any goods 5% is applicable then user easily knows which group code needs to be selected.

2. I have added one field on GST Group Code master to specify rate for the group. You can specify any rate in decimal format that is applicable under GST laws.

3. Then on the same page I have added three actions.

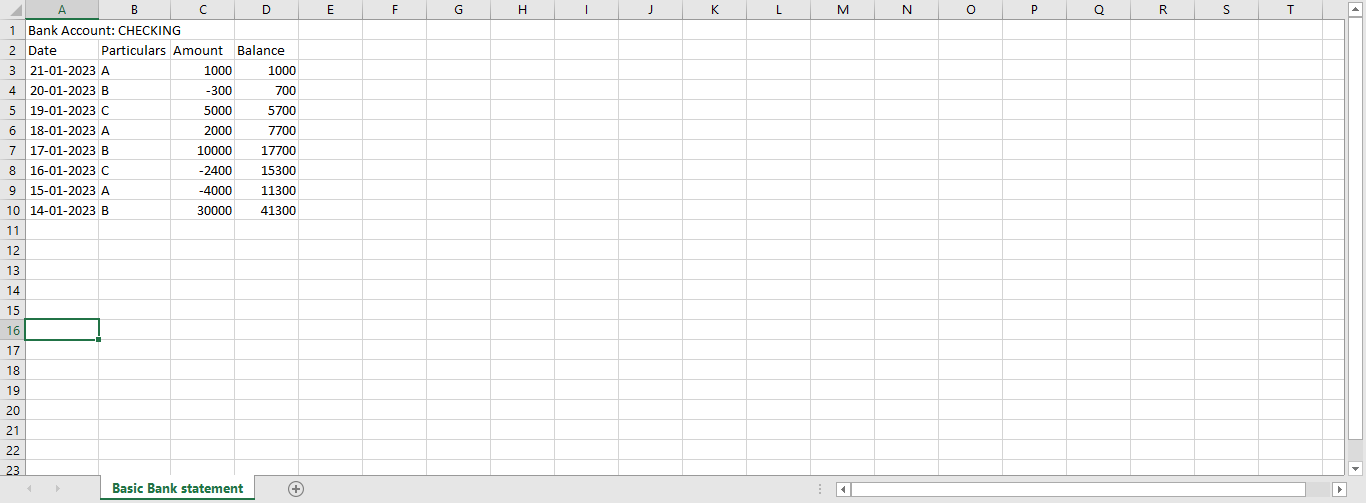

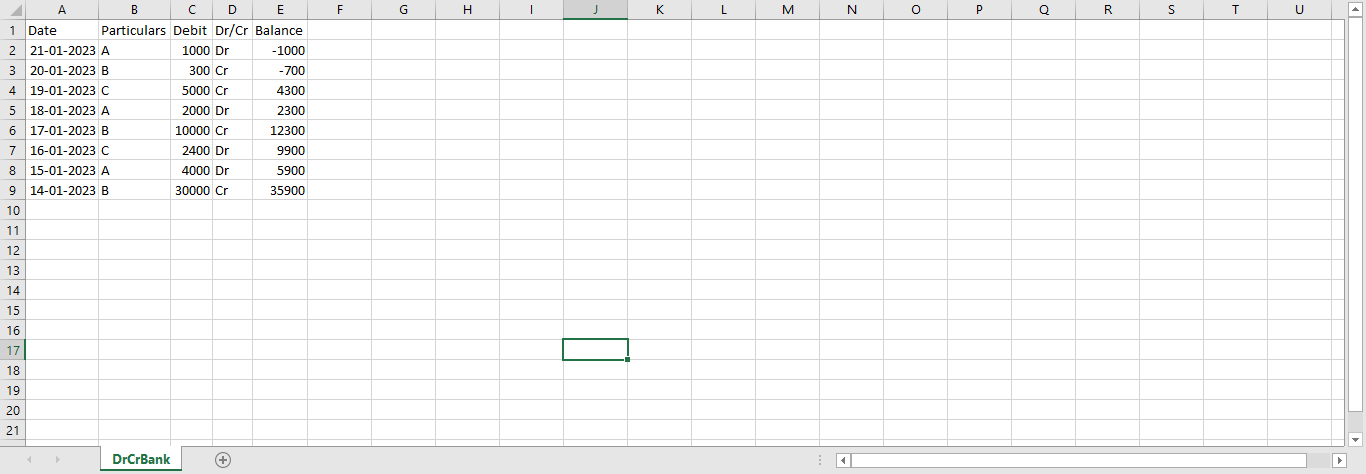

GST Excel Report - This function will run the report and generate the excel file containing all the GST Rates in the format that can be directly imported into system.

Delete All - This is same standard action available in GST Rates page. This will delete all the existing rates from GST Rates page. Make sure to delete all the existing rates before you import rate file because if there will be any duplicates, system will not allow you to import the generated file.

Import from Excel - This is the same standard function available in GST Rates page. This will help to import the file that is generated in excel.

4. When you click on GST Excel Report action system will open report run page. Here you need to specify starting and ending date for your GST rates. In Second tab of Specific rate, if you want to generate GST rates for all Group codes then keep it blank but if you want to generate rates for specific HSN/SAC code then you can turn on Create HSN Specific Boolean and provide GST Group Code, and HSN/SAC code to generate rates for that HSN/SAC code only.

5. When you click on Ok, system will generate Excel which will include all the GST rates.

6. Now click on Import from Excel action and import the file that is generated.

7. System will verify the file and import all the rates. You can view all the imported rates in GST Rates page.

End of functionality.

I hope the blog and this functionality both will be useful for everyone. As this functionality is easy to develop, I am not sharing screenshots of the AL code but if you need the same you can email me at dhirennagar97@gmail.com and I will provide you AL code files for the same.

I will keep posting knowledge sharing blogs whenever I find any interesting topic on Business Central till then Happy Reading! Thank you for your time.

Comments

Post a Comment